The holiday season is upon us once again. For many parents, it is a magical stretch of twinkling lights, excited kids, family traditions, and the yearly challenge of delivering a memorable Christmas without going overboard financially. Although parents say they love creating special moments for their children, the cost of doing so continues to rise, and families across the country are feeling the pressure more than ever.

Following up on our report from last Christmas, we're taking an updated look at how rising gift budgets, tariff concerns, and the overwhelming number of parents relying on debt are shaping this year's holiday story into one of generosity mixed with financial strain. We'll also look at how some parents are responding by finding inventive ways to cut costs, hunt for deals, and make the season special without overspending.

Key Takeaways:

-

Parents expect to spend $521 per child, on average, this Christmas (a 13% increase from 2024's $461).

-

Nearly 6 in 10 parents, 58%, expect to go into debt to pay for Christmas this year (up from 49% in 2024).

-

Buy Now, Pay Later services (BNPL) have surged in popularity, with 43% planning to use them (more than double last year's 21%).

-

63% of parents say tariffs have negatively impacted their ability to give their children the Christmas they'd like.

-

More than half of parents, 54%, don't save specifically for Christmas expenses throughout the year.

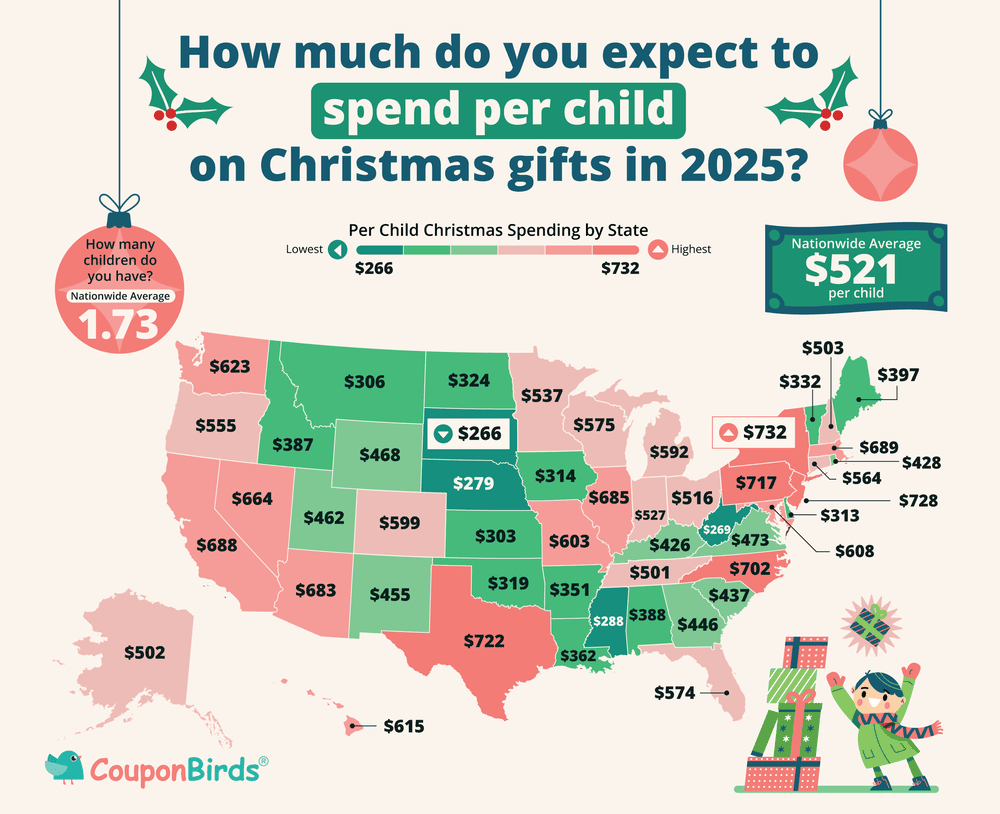

How Much Do Americans Expect to Spend Per Child on Christmas Gifts in 2025?

This year's average expected budget of $521 per child, represents a 13% increase compared to last Christmas. Some shopping budgets are fast approaching amounts equivalent to rent or mortgage payments, while others remain moderate.

-

Going Overboard: 12% are dropping $1,000 or more per child this year (up from 9% last year).

-

The Splurgers: 15% will spend $750 to $999 per kid, clearly willing to stretch their wallets significantly for the holidays.

-

Middle of the Road: Nearly a third, 30%, plan to spend $500 to $749 per child, representing the most common spending tier. Meanwhile, a quarter of parents keep things in the $250 to $499 range, proving meaningful gifts don't require mortgage-sized budgets.

-

Savvy Budgeters: 15% stick to a $100 to $249 per child limit.

-

Minimalist Masters: Just 3% plan to spend under $100, determined to create holiday magic regardless of their modest budget.

Christmas Gift Spending Per Child By State: Who's Spending More (or Less) Than Last Year

Some states are seeing sharp year-over-year increases, while others are actually pulling back a bit. Local economies, cost of living, and even regional attitudes toward holiday gifting all play a part. Most states are planning to spend more in 2025, but a handful are clearly bucking the trend.

Highest Spenders:

-

New York: $732 (jumped from $598, a 22% increase from last Christmas)

-

New Jersey: $728 (rose from $712, staying near the top)

-

Texas: $722 (up from $659, maintaining its big-spending reputation)

Frugal Savers:

-

West Virginia: $269 (increased from $255, but still the most modest nationwide)

-

South Dakota: $266 (up from $247 in 2024)

-

Nebraska: $279 (rose from $263, keeping spending controlled)

Budget-Cutters:

-

Mississippi: $288 (dropped from $303, a 5% decrease)

-

Iowa: $314 (fell from $335, down 6%)

-

Vermont: $332 (down slightly from $343)

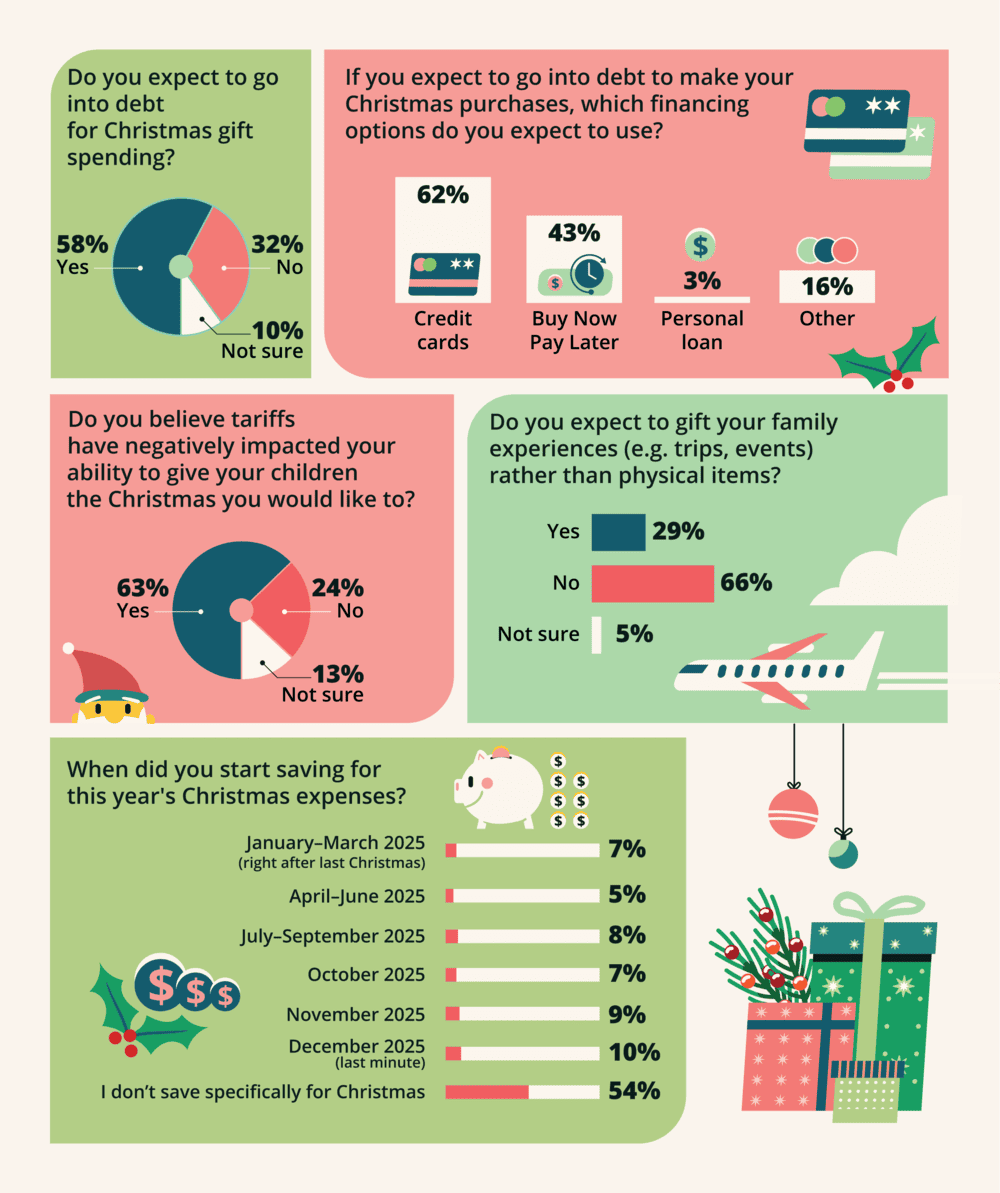

The Growing Debt Dilemma: More Families Borrowing to Make the Season Bright

A majority of parents expect to take on debt to afford Christmas. In fact, 58% say they will go into debt to buy gifts for their children, a significant jump from 49% just one year ago. Only 32% expect to stay debt-free (down from 46%), while 10% remain uncertain about their financial trajectory.

The dreaded January credit card statement has become an expected holiday hangover, often causing financial stress in the new year that can zap away holiday joy in an instant.

CouponBirds Expert Tip: Before making any purchase, calculate the true cost, including interest if you won't pay immediately. That $100 gift financed at 22% APR over six months actually costs $111. Knowing the real price helps inform better decisions.

Credit cards remain the top tool for financing holiday gifts, with 62% expected to use them. The real headline, though, is Buy Now, Pay Later's meteoric rise to 43%, more than doubling from last year's 21%. Traditional personal loans remain rare at 3%, with 16% exploring other alternatives.

Buy Now, Pay Later use continues to climb, solidifying itself as a core part of the modern holiday budget. With 43% relying on a BNPL service, it's no longer a fringe option. It is officially a mainstream way to bridge the gap between what families want to give and what they can afford in the moment. These services promise pain-free purchasing by dividing costs into bite-sized payments or delaying payment for a period of 30 days. No credit check, no interest (usually), no guilt. The catch? It's remarkably easy to lose track of multiple payment schedules across different platforms, and missed payments trigger hefty fees.

CouponBirds Expert Tip: Create a spreadsheet tracking every BNPL commitment, including due dates, amounts, and which payment method is linked. Set phone reminders for two days before each payment. The organizational effort required might even discourage overspending in the first place.

Tariffs Shift From Anxiety to Reality

For the first time in several years, tariffs have become a major factor in holiday concerns. Nearly two-thirds of parents (63%) report that tariffs have directly diminished their purchasing power, with only 24% feeling unaffected and 13% uncertain about the impact on their ability to give their children the Christmas they would like.

Experiences vs. Physical Gifts

The experiential gift movement is gaining ground, though physical presents still dominate. This year, 29% of parents plan to gift experiences like museum memberships, concert tickets, or family trips (up from 24% last year). The majority (66%) stick with traditional wrapped gifts, while 5% remain undecided.

Experience gifts offer distinct advantages: they don't clutter closets, they create lasting memories, and they often bring families together in meaningful ways. The anticipation of a trip to an amusement park or tickets to a memorable show forms part of the excitement and transforms into stories told for years to come.

CouponBirds Expert Tip: Bridge the gap by wrapping a small physical item that represents the upcoming experience. Pair convention passes with a pack of Pokémon cards, concert tickets with a band t-shirt, or camping trip reservations with a new flashlight. Kids get the unwrapping excitement while still receiving the deeper gift of shared experiences.

Most Parents Don't Plan Ahead for the Holidays

One of the clearest indicators of holiday stress is how early families begin preparing for it. This year, the answer for most parents is simple: they did not. More than half of respondents, 54%, say they do not save specifically for Christmas at all. Among the parents who do set money aside, the timing is all over the map.v

-

January to March 2025: 7%

-

April to June 2025: 5%

-

July to September 2025: 8%

-

October 2025: 7%

-

November 2025: 9%

-

December 2025: 10%

It is not hard to see why so many parents end up leaning on credit cards and BNPL to get through the season. Without a dedicated savings runway, the sudden spike in holiday spending becomes difficult to manage. Even parents who do save often begin late in the year, leaving little time to build a meaningful cushion.

CouponBirds Expert Tip: Open a dedicated holiday savings account in January and automate small transfers with each paycheck. Even $40 per bi-weekly paycheck creates a $1,000 cushion by December. The key is automation, which removes the temptation to skip a month and quietly builds a buffer for the next holiday season.

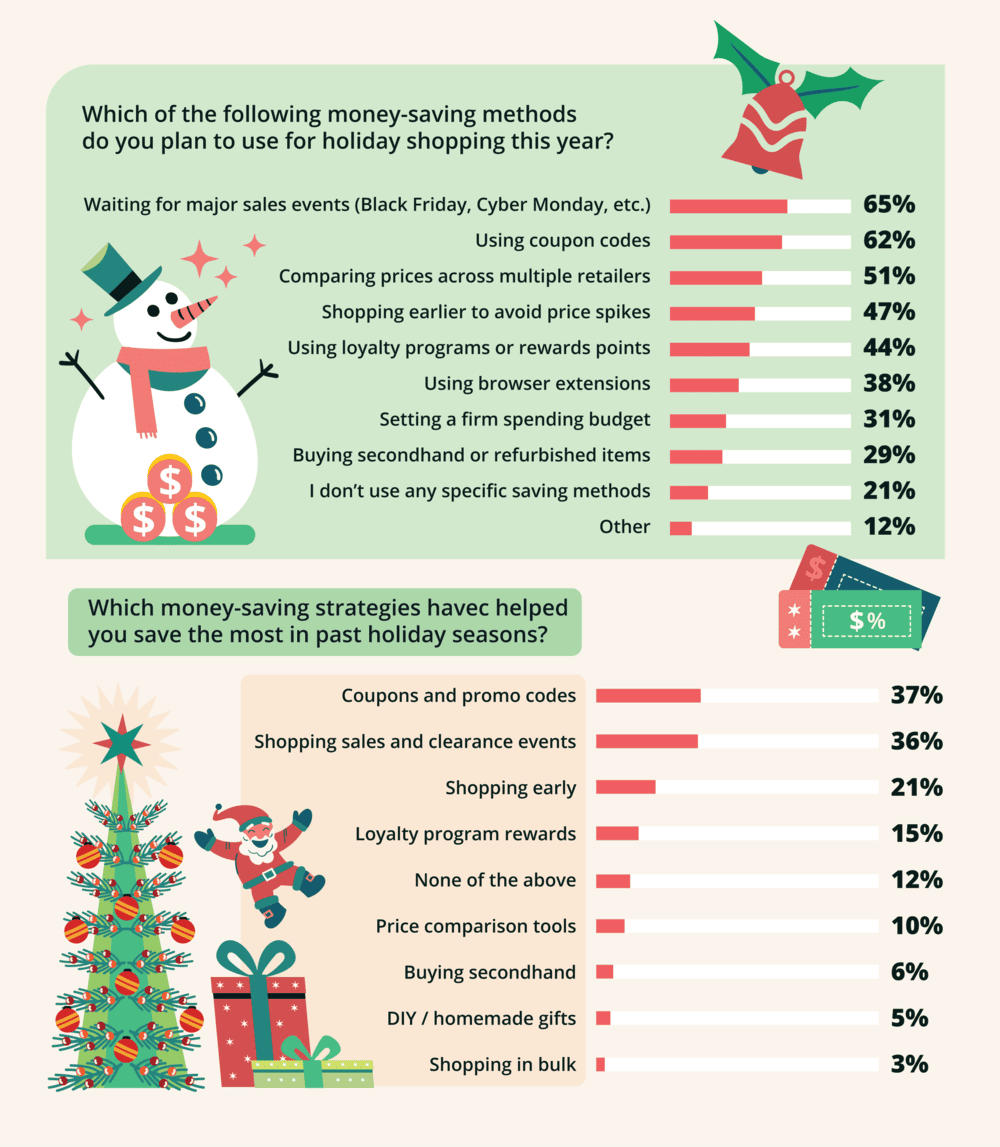

Money Saving Methods for the 2025 Holiday Shopping Season

Even without much saved ahead of time, parents know how to make their money work. They turn to a mix of tried and true strategies to stretch every dollar as far as it will go. Resilient shoppers hunt for deals with an intensity that would make professional bargain-seekers proud.

The dominance of Black Friday and Cyber Monday shopping tells us that parents still rely on traditional deal hunting. But what stands out this year is the share who are shifting their shopping earlier. With retailers eschewing traditional Black Friday timelines and starting deals before Thanksgiving, 47% of consumers have moved up their gift buying to take advantage of earlier sales and mitigate bargain FOMO.

CouponBirds Expert Tip: Combine multiple tactics for compounding savings. Start by joining store loyalty programs and signing up for email lists (use a dedicated email address to avoid inbox chaos). Install coupon code extensions that find the internet's best coupon codes, then wait for major sale events to make purchases, paying with a cashback credit card. This layered approach can reduce total spending significantly without sacrificing quality.

Making Christmas Meaningful Without Overspending

What children remember most are the traditions, the excitement, and the time together, not the cost of the gifts. Families looking to enjoy the season without financial stress are focusing on honest budgeting conversations, savvy sale shopping, and choosing thoughtful gifts over expensive ones. Simple traditions like baking, movie nights, or homemade presents are also helping parents create meaningful moments without straining their wallets. Even as prices rise, families continue finding creative ways to make Christmas feel special in 2025.

Methodology

This survey was conducted in November 2025 among 2,500 American parents (50 from each state), with 56% identifying as women, 43% as men, and 1% as non-binary.

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Comments